indiana excise tax form

In Indiana liquor vendors are responsible for paying a state excise tax of 268 per gallon plus Federal excise taxes for all liquor sold. INDIANA PROPERTY TAX BENEFITS State Form 51781 R76-09 Prescribed by the Department of Local Government Finance INSTRUCTIONS.

Model year 1980 or older passenger vehicles trucks with a declared gross weight of not more than 11000 pounds and motorcycles are charged a flat rate vehicle excise tax of 1200.

. Box 7089 Indianapolis IN 46207-7089 Nonprofit. Fill in all the required fields they will be yellow-colored. Is the county wheelsurcharge.

For more information about cigarette excise taxes or other tobacco product excise tax please contact DOR Special Tax Division. THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER Listed below are certain deductions and credits that are available to lower property taxes in Indiana. Indiana Liquor Tax - 268 gallon.

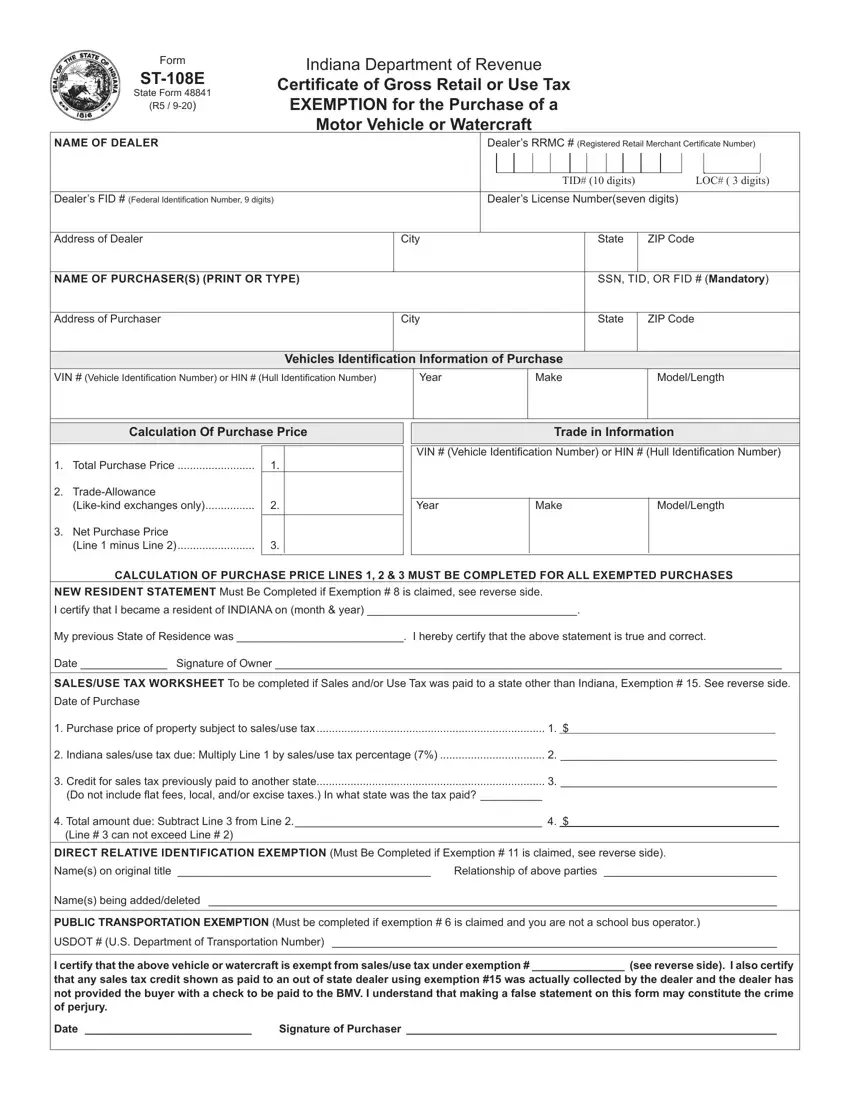

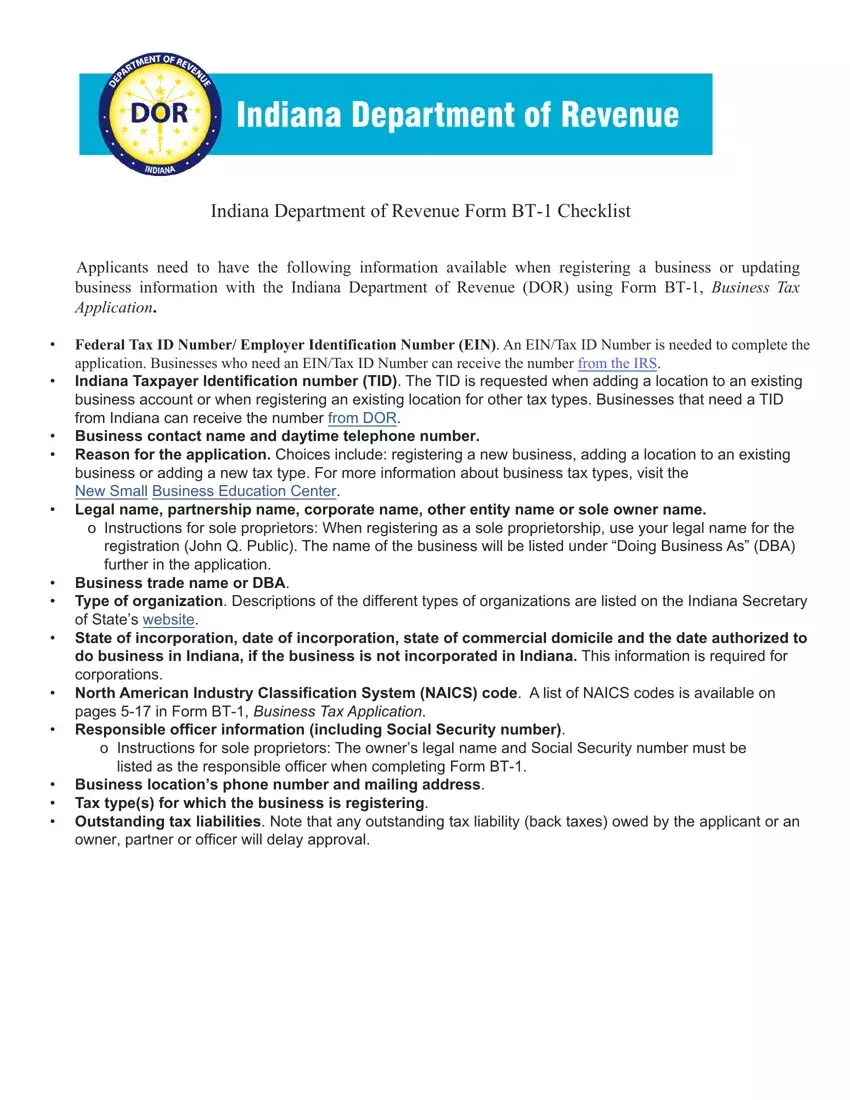

Ten-digit Indiana taxpayer identification number TID. On September 16 2014 the BMV announced that it had determined that some Hoosiers vehicles were misclassified for excise tax purposes. Form 8849 Claim for Refund of Excise Taxes PDF.

Form 8864 Biodiesel and Renewable Diesel Fuels Credit PDF. If the fuel is being used in a vehicle the declared. Excise Police Indiana State 10 Articles Follow New articles New articles and comments Do I need any type of permit to dispense alcoholic beverages at my one time event.

Form 8821 Tax Information Authorization PDF. About 185000 or 36 percent of the 51 million Hoosiers who registered vehicles with the BMV. Find Indiana tax forms.

The Indiana gas tax is included in the pump price at all gas stations in Indiana. Anyone who purchased un-dyed special fuel or gasoline paid the Indiana excise tax andor surcharge tax and later used it for an exempt purpose. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A depending on your circumstances.

The gasoline use tax does not affect form MF-360 and licensed gasoline distributors will need to continue to report gasoline. Know when I will receive my tax refund. State Form 55569 R 5-14 ALC-FW Form Indiana Farm Winery Excise Tax Return Reporting Month ______________ Year ________ Indiana Department of Revenue Amended Return No Activity This return must be postmarked on or before the 20th day of the month following the reporting month.

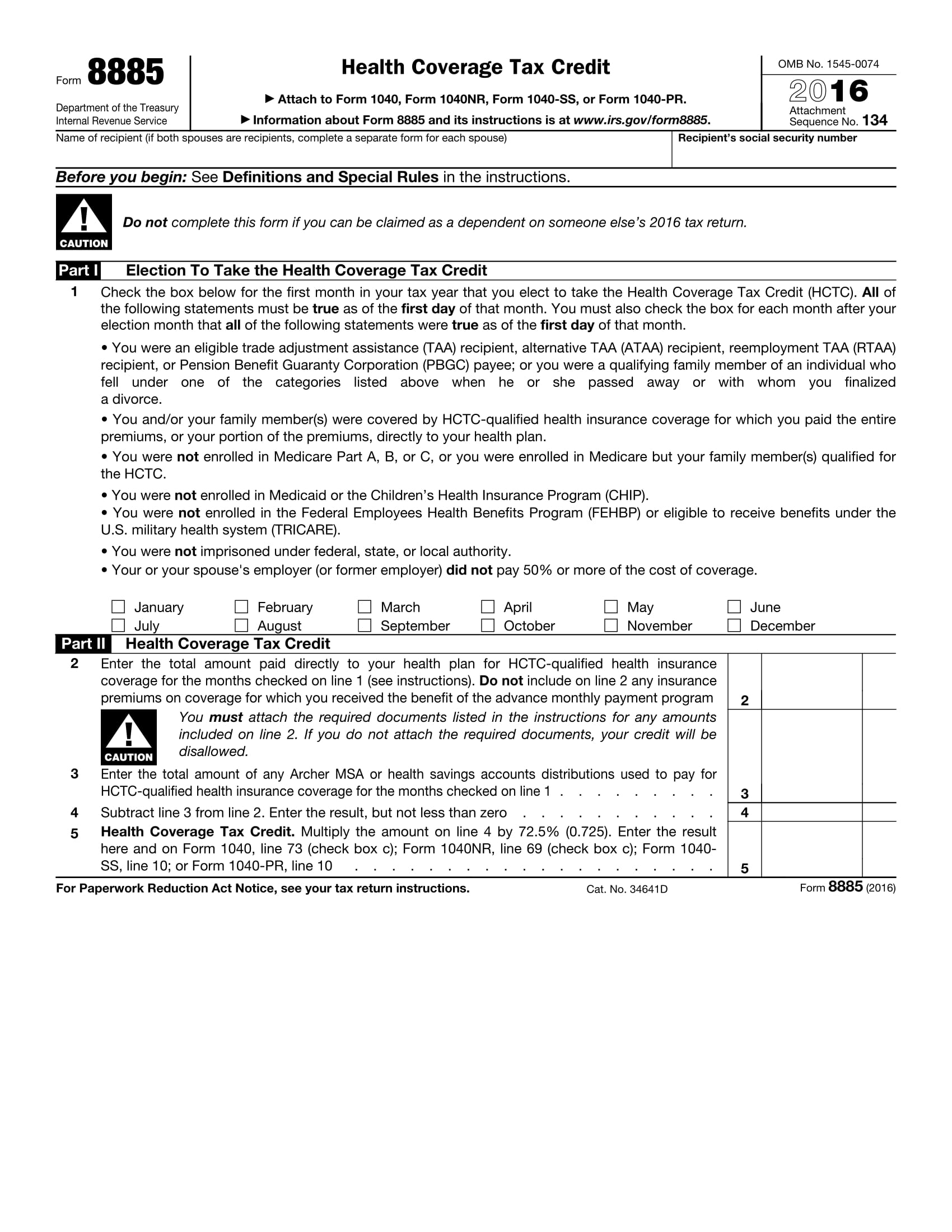

Form 720 is used to file many types of excise tax including the indoor tanning services excise tax. Complete all the requested boxes they are yellowish. Choose the Get form button to open it and start editing.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Indianas excise tax on gasoline is ranked 19 out of the 50 states. The exemptions provided in IC 6-25-5 apply to gasoline use.

For more information about the technical requirements for submitting files please contact the DOR Information Technology Division. If the only excise tax you need to report is for indoor tanning services. You should consult your tax professional to determine whether this will apply to you.

Form 6478 Biofuel Producer Credit PDF. The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states. Vehicle Excise Tax Flat Rate 12.

If you do not have an Indiana TID leave the space blank and one will be assigned to you. Indiana Form IT-40X Amended Tax Return for Forms IT-40 IT-40PNR or IT-40RNR Use this form to amend Indiana Individual Forms IT-40 IT-40PNR or IT-40RNR for tax periods beginning before 01012021. APPLICATION FOR VEHICLE EXCISE TAX BUREAU OF MOTOR VEHICLES CREDIT REFUND Central Office Title Processing State Form 55296 R3 7-17 100 N.

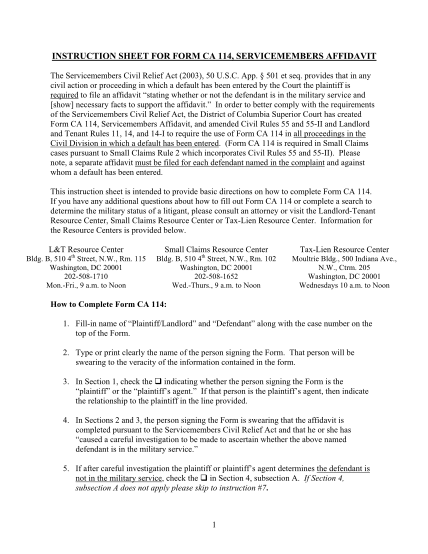

AFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAX State Form 46402 R4 2-13 INDIANA BUREAU OF MOTOR VEHICLES SECTION 1 - APPLICANT AFFIRMATION To receive a military exemption from excise tax all of the following criteria must be met. I am serving on active military duty in the armed forces of the United States. Fill out Release Of Interest In Indiana License Plate And Excise Tax - Forms In in several minutes by simply following the instructions below.

In addition the tax does not affect collecting remitting or reporting Indianas 18-cents-per-gallon gasoline tax and 1-cent-per-gallon oil inspection fee. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Complete your information at the top of the form name address etc Enter the amount of tax paid on page 2 Part II IRS No.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Motor Vehicle Rental Excise Tax. I am currently residing in the.

As a result those customers overpaid excise taxes when registering their vehicles. Under 15 047gallon. Pick the template you will need from our collection of legal forms.

Click the Get form key to open the document and begin editing. Visit the Forms and Pubs page for a complete. Indianas general sales tax of 7 also applies to the purchase of liquor.

File and pay Form. Excise Refund Claim Form. 140 Sign and date at the bottom of page 2.

Complete Indiana Brewers Excise Tax Report - FormSend within a couple of moments following the recommendations below. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000. Find the template you require in the collection of legal forms.

Form 6627 Environmental Taxes PDF. Include extension numbers when applicable. Taxpayer Information Name As It Appears on Permit Physical.

APPLICATION FOR VEHICLE EXCISE TAX CREDIT REFUND. Senate Avenue Room N417 Indianapolis IN 46204 INDIANA BUREAU OF MOTOR VEHICLES 888 692-6841. Publication 3536 Motor Fuel Excise Tax EDI Guide PDF.

Publication 510 Excise Taxes PDF. The REF-1000 form is used to file for a refund of un-dyed special fuel excise tax gasoline excise tax and surcharge tax. Telephone Number Indicate the point of contact phone number for the persons responsible for completing this return.

When amending for tax periods beginning after 12312020 use Forms IT-40 IT-40PNR or IT-40RNR for that tax period and check the Amended box at the top right corner of. My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee.

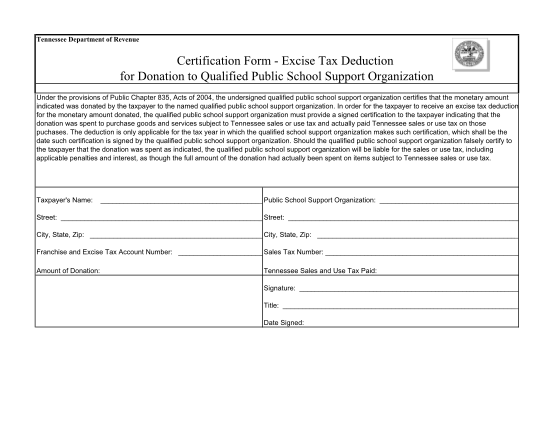

57 Donation Form Template Free To Edit Download Print Cocodoc

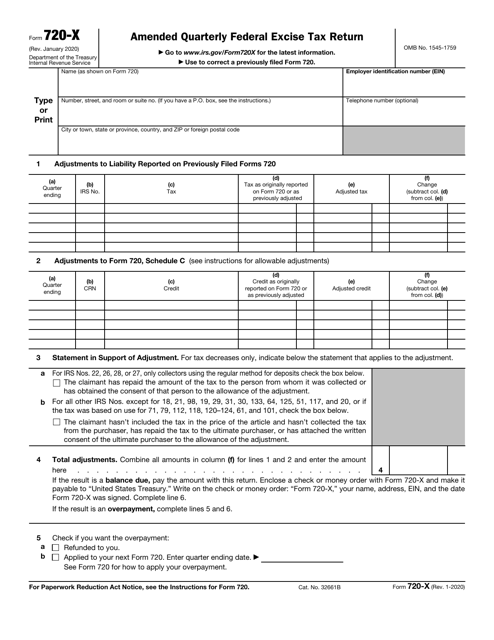

Irs Form 720 X Download Fillable Pdf Or Fill Online Amended Quarterly Federal Excise Tax Return Templateroller

In Form Bt 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

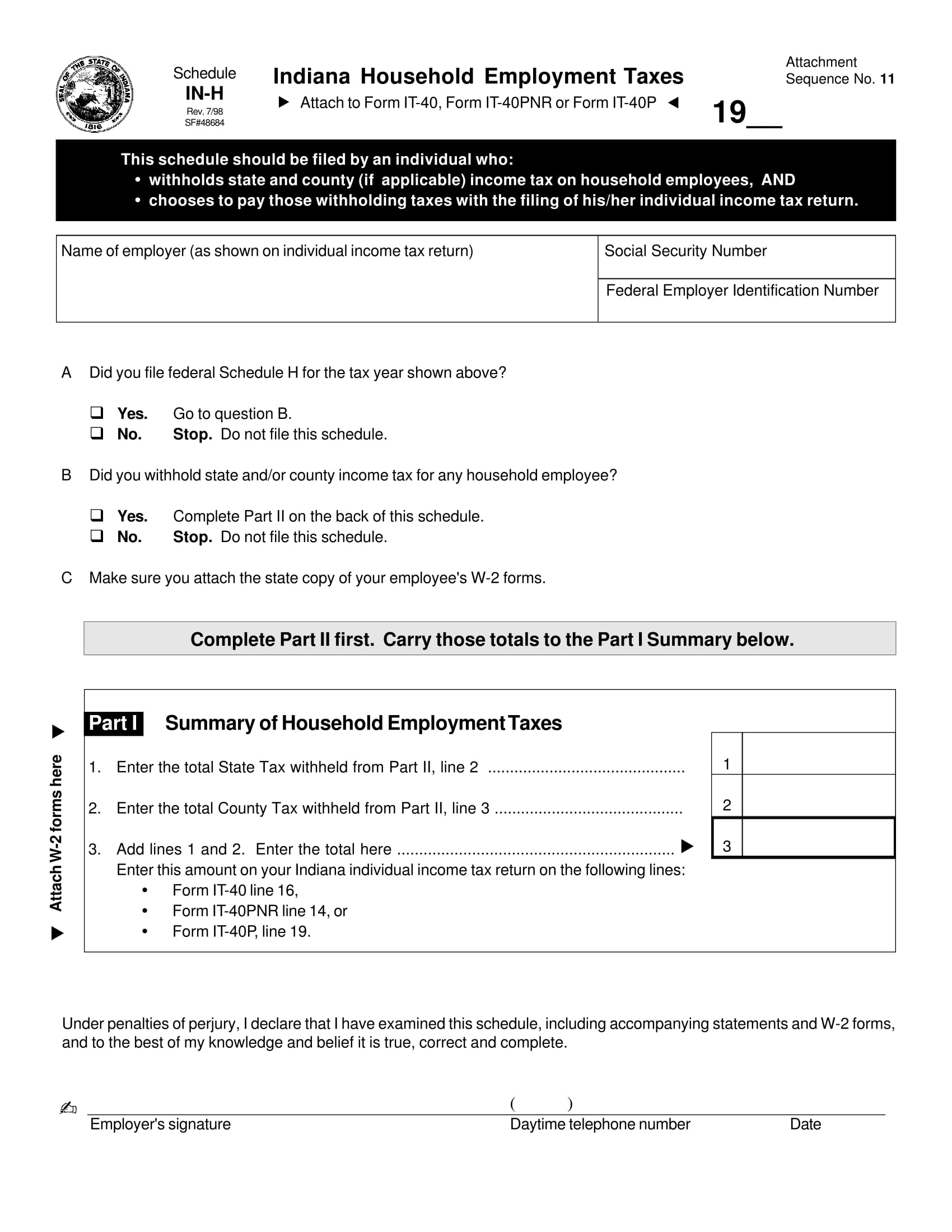

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

96 Blank Form 114 Page 6 Free To Edit Download Print Cocodoc

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

St 108e State Form Fill Out Printable Pdf Forms Online

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Form 5330 Everything You Need To Know Dwc

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

Form 8582 Passive Activity Loss Limitations 8582 Pdf Fpdf Docx Official Federal

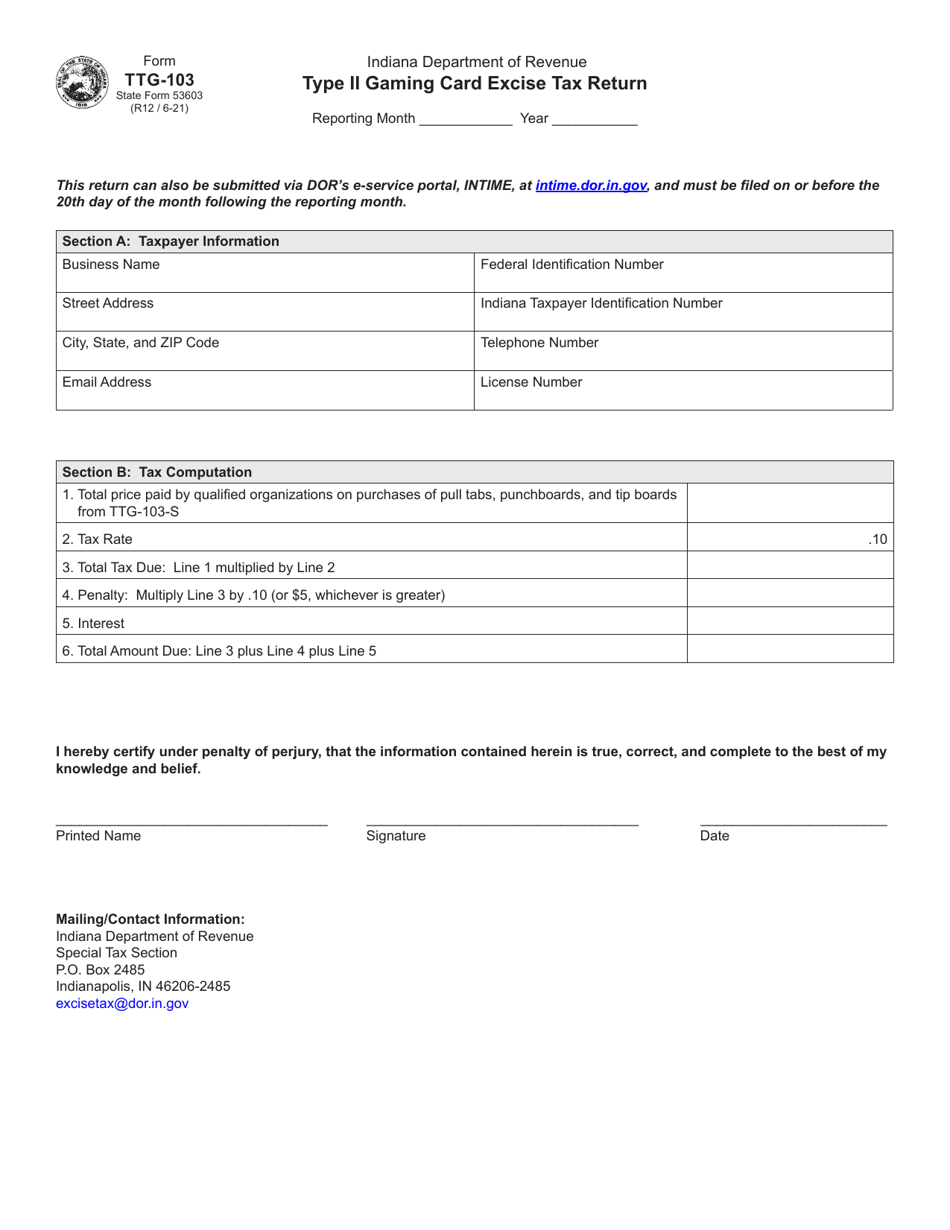

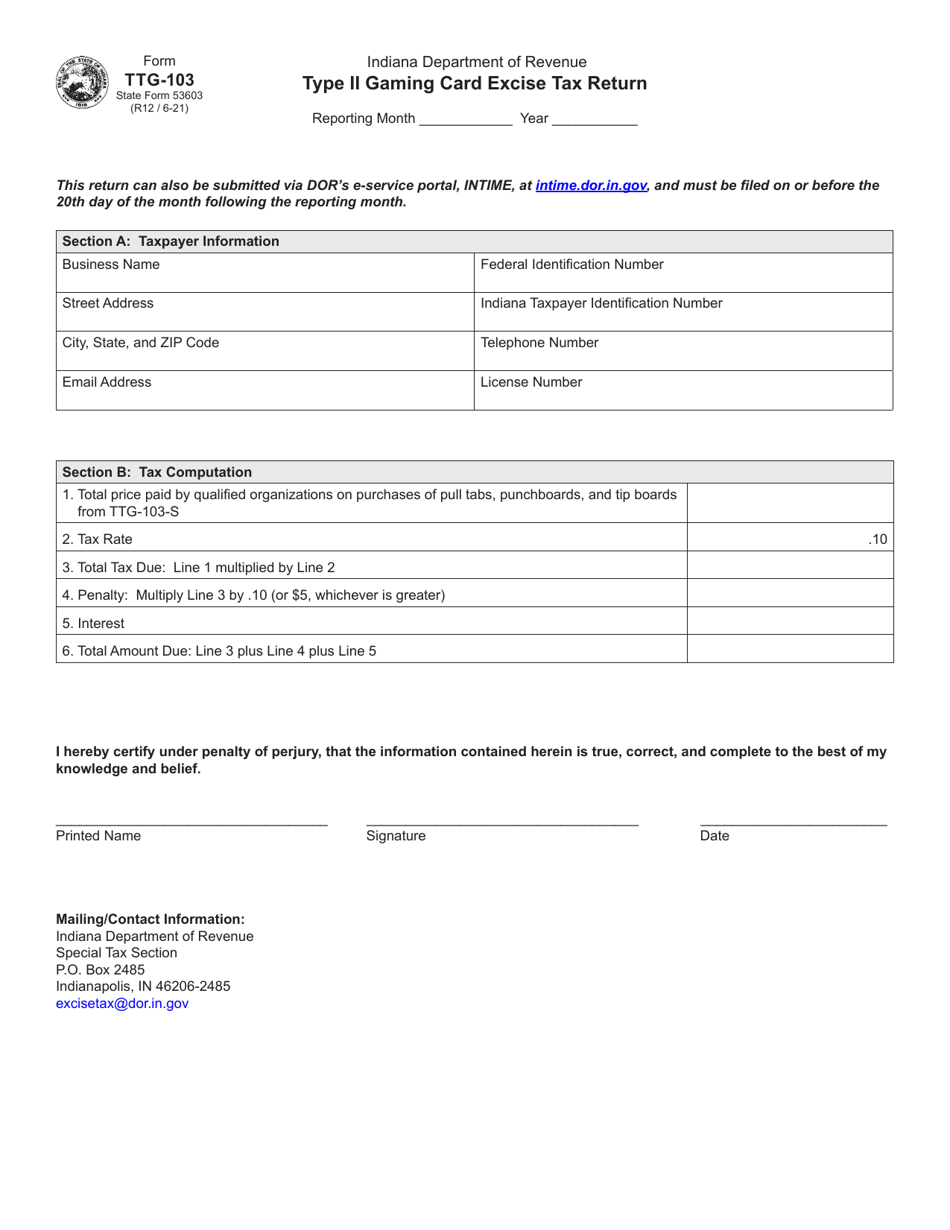

Form Ttg 103 State Form 53603 Download Fillable Pdf Or Fill Online Type Ii Gaming Card Excise Tax Return Indiana Templateroller

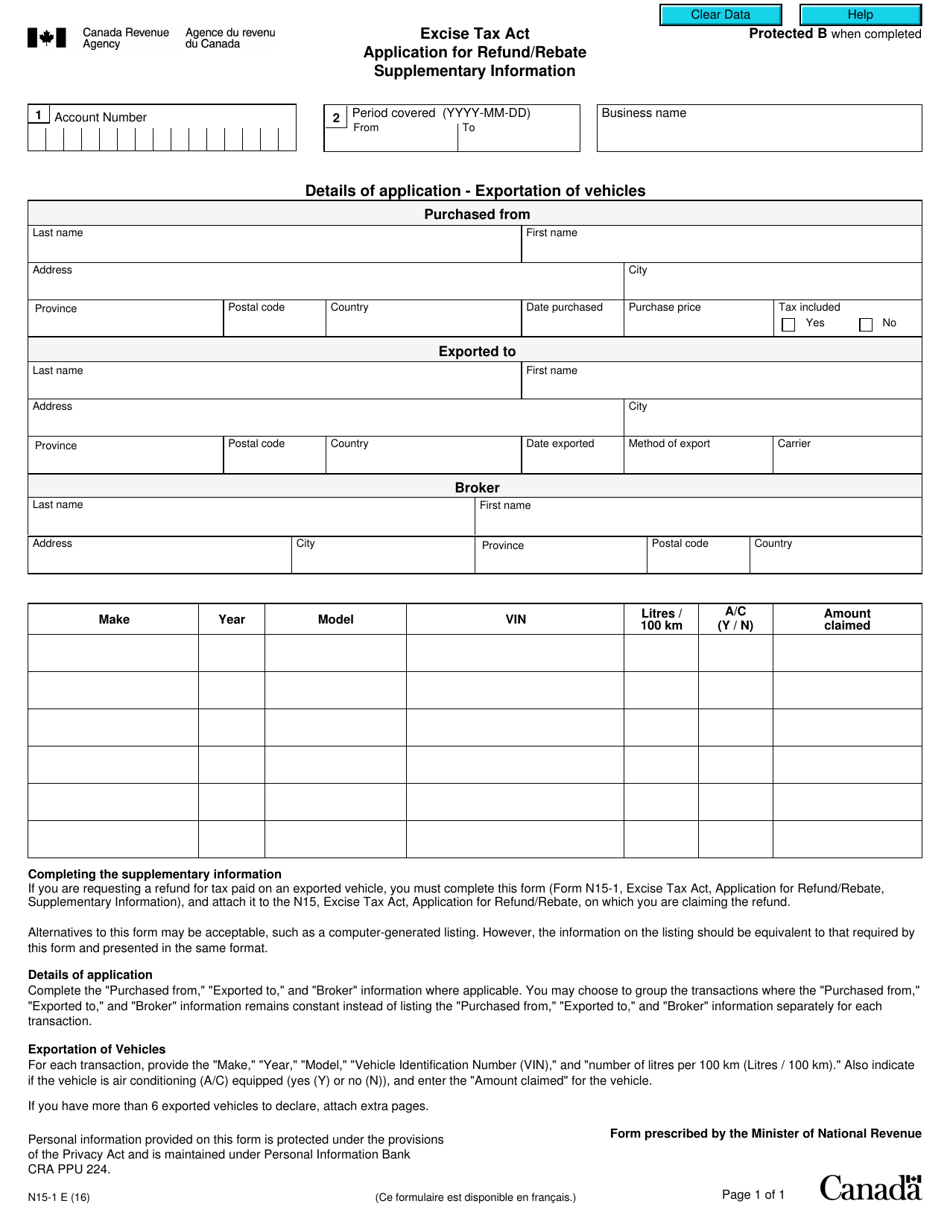

Form N15 1 Download Fillable Pdf Or Fill Online Excise Tax Act Application For Refund Rebate Supplementary Information Canada Templateroller