us exit tax form

Net capital gain after an exemption from the deemed sale is taxed immediately. Would not have been considered a resident of the US.

Browse Our Example Of Offboarding Checklist Template Checklist Template Checklist Financial Checklist

Citizenship or long-term residency triggers both the exit tax and the inheritance tax.

. Presuming the person who expatriates qualifies as a covered expatriate they will have to conduct an exit tax analysis using Form 8854. The Basics of Expatriation Tax Planning. Ad Dont Miss The April 18 Tax Deadline.

Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. THE UNITED STATES EXIT TAX 5 a. Having planned and executed an entry into the US.

Became at birth a citizen of the US. Please print or type. Ad For Simple Returns Only File Free Now Even When An Expert Does Your Taxes.

The IRS will not tax you a second time. Citizens and long-term residents must carefully plan for any proposed expatriation from the US. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

US Exit Tax IRS Requirements. To clarify this is not a separate or an additional tax. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

Relinquishing a Green Card. And another country and as of the expatriation date contin-ues to be a citizen of such other country and taxed as a resident of such country. The exit tax rules apply to citizens and Legal Permanent Residents Green-Card Holders who qualify as LTR Long-Term Residents.

IRS Form 8854 the Expatriation Information Statement is the Exit Tax form and its filed along with your final return. As provided by the IRS. This determines the gain on your assets as well as the taxable amount of this above the threshold.

You are free to move about the planet. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax. Only 26 days to e-File Your Taxes.

Once you have paid the exit tax either in a giant lump sum up front or because of the 30 withholding made on payments as you receive them you have cash in your pocket. Form 8854 2021 Department of the Treasury Internal Revenue Service. Tax may be potentially avoided by limiting income and net worth through gifts.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

The percentage of exit tax is different for everyone as it is based on your marginal tax rates. For calendar year 2021 or other tax year beginning 2021 and ending 20. Initial and Annual Expatriation Statement.

Withholding and other requirements b that you tell the payer of your ex-citizen status there actually is an IRS form for this Form W-8CE and c that you permanently and irrevocably waive all claims to a reduction. With the introduction of FATCA Reporting increased aggressive enforcement Foreign. Tax person may have become a US.

Exit Tax Consists of Several Things. Citizens who expatriate in 2020 there may be IRS exit tax consequences. The exit tax rules impose an income tax on someone who has made his or her exit from the US.

File On Your Own With Expert Help Or Get A Full Service Experience. The 8854 form is filed in the year after expatriation. But if you are a Green Card holder and have only had it for.

Citizens and Permanent Residents who are considered long-term residents file IRS Form 8854. Currently net capital gains can be taxed as high as 238 including the net. The Form 8854 Expatriation Statement is the form used to tell the IRS that the taxpayer has renounced their citizenship and declares whether or not they are a Covered Expatriate and works out the amount of deemed taxable income subject to the exit tax.

Tax resident or citizen by virtue of having acquired a green card or citizenship see Garcia Tax Planning for High-Net-Worth Individuals Immigrating to the United States The Tax Adviser April 2016 and Garcia and Qian Tax Planning for a. For Green Card Holders and US. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US.

The phrase exit tax that we use consists of four different ways in which you. To qualify for this treatment the deferred compensation must be eligible which means a that the payer must be a US. The current form of exit tax deems sold all assets held worldwide by the expatriate.

We have summarized the Form and instructions. The Not Filing On Time Penalties Are Generally Higher Than Not Paying Taxes on Time. For instructions and the latest information.

Tax on individualsthe Exit Tax Americans have to pay when they give up their US. Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US. Exit Tax and Expatriation involve certain key issues.

Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. Entity or if non-US must agree to US. For example if a Long-Term Resident relinquishes citizenship in 2019 then in 2020 when he files his 2019 tax return he includes the Form 8854.

The most important aspect of determining a potential exit tax if the person is a covered expatriate. Tax system a formerly non-US. If your renunciation date is any day other than December 31st youll be filing Form 1040 and 1040NR if applicable for your final return.

In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. Under the substantial presence test of IRC.

This tax is based on the inherent gain in dollar terms on all your assets including your home. How to calculate exit tax. Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

By contacting a tax accountant they can estimate the.

Letter Requesting Authorization To Release Credit Information Lettering Release Credits

Corporate Acknowledgement Affidavit Free Fillable Pdf Forms Everyone Knows Business Analysis Corporate

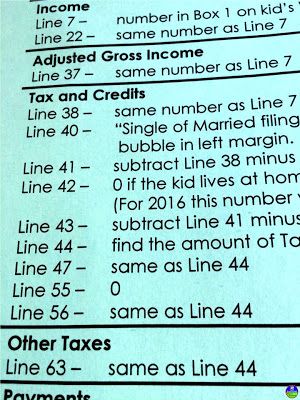

1040 Income Tax Cheat Sheet For Kids Consumer Math Income Tax Financial Literacy

Job Application Form Template Word Luxury Microsoft Word Job Application Template Job Application Template Employment Application Word Template

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Digi Page Dp 01 January 2017 Ga Sgb Study Materials Application Form Gold Bond

Infographic 9 Step For Beginner Property Investors Wma Property Property Investor Investment Property Rental Property Management

Small Business Reference Center Is A Resource For Small Business Owners And Those Interested In Starting A Business Entrepreneur Sample Business Plan Business

12 Ways To Maximize Your Value Added Tax Refund When Shopping Overseas Tax Refund Value Added Tax Refund

What To Do When The Irs Needs To Verify Your Identity Identity Theft Verify Identity Identity Thief

Small Business Guide For Americans Abroad Myexpattaxes Budgeting Small Business Marketing Budget

Sample Notice Of Assignment Free Fillable Pdf Forms Assignments Sample Form

Contractor Proposal Template Free Inspirational Construction Proposal Template Proposal Templates Templates Business Proposal Template

What Is Your Business Exit Strategy Orr Litchfield Solicitors In 2022 Exit Strategy Preparing A Business Plan Business Lawyer

All About Sids Filing Taxes Tax Preparation Tax Deductions

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Income Tax Payroll Taxes